Understanding Network Hospitals in Health Insurance in the UAE

In the United Arab Emirates, where healthcare standards are among the highest globally, understanding how your health insurance policy connects with network hospitals is vital. The concept of a hospital network is central to how insurers manage healthcare costs, ensure service quality, and streamline claim processes. Yet, many policyholders remain unclear about what network hospitals are, how they operate, and the implications of choosing one network over another.

In essence, network hospitals are healthcare providers that have entered into an agreement with insurance companies or Third-Party Administrators (TPAs) to offer cashless medical services to insured individuals. When policyholders seek treatment at these facilities, the insurer directly settles the bill with the hospital, minimizing out-of-pocket expenses for the patient.

Understanding your hospital network is crucial for three reasons:

- Financial Efficiency: Cashless benefits reduce liquidity strain during medical emergencies — supported by sound financial planning and advisory expertise in the UAE.

- Access to Quality Healthcare: Only accredited, regulator-approved hospitals are typically included in insurer networks.

- Policy Compliance: UAE health authorities—particularly the DHA (Dubai Health Authority) and HAAD (Health Authority – Abu Dhabi) mandate specific minimum benefits that link closely with approved hospital networks.

In the UAE’s regulated insurance market, this knowledge helps both individuals and corporates make informed decisions about medical coverage. Whether purchasing an individual plan or a group policy for employees, knowing how network hospitals operate ensures efficient, compliant, and cost-effective healthcare management.

What Are Network Hospitals?

Definition and Core Concept

A network hospital is a healthcare facility approved by an insurance company to provide services under a direct billing arrangement. This means that when an insured individual undergoes treatment, the hospital bills the insurer (or TPA) directly, instead of charging the patient.

Network agreements benefit all parties involved:

-

Insurers ensure standardized rates and cost control, guided by efficient transaction and business valuation advisory frameworks that help manage healthcare expense models.

-

Hospitals receive consistent patient inflow and prompt payment, contributing to transparent financial operations — similar to Kingsley Maybrook’s focus on regulatory compliance and tax structuring in the UAE.

-

Policyholders gain hassle-free access to healthcare without large upfront payments, aligning with long-term wealth and succession planning for family financial stability.

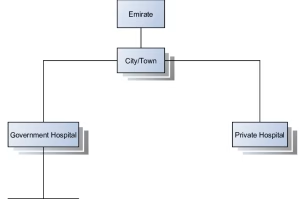

In the UAE, insurance companies like Daman, AXA, and Orient maintain extensive hospital networks across Emirates, ensuring accessibility for residents and expatriates alike.

Cashless vs. Reimbursement Model

Two major claim models exist in UAE health insurance:

- Cashless Model:

- Applicable at network hospitals only.

- The insurer settles the bill directly with the provider.

- Requires pre-authorization for planned treatments.

- Reimbursement Model:

- Applies when treatment is sought outside the insurer’s network.

- The policyholder pays upfront and later submits bills for reimbursement.

- Typically involves longer claim processing times and partial recoveries.

- Direct billing reduces financial stress during emergencies.

- Cashless services improve patient experience.

Out-of-network care may still be covered, but through reimbursement.

Types of Network Hospitals in the UAE

Tier-Based Categorization (Gold, Silver, Basic)

UAE insurance providers often classify network hospitals into tiers, reflecting the level of service, geographical spread, and pricing. The most common tiers are:

- Basic Network:

- Limited to smaller clinics and select hospitals.

- Designed for entry-level health insurance plans.

- Cost-efficient but geographically restricted.

- Standard Network:

- Balanced access to mid-range hospitals across Emirates.

- Broader coverage and flexibility.

- Ideal for families or small businesses.

- Premium Network:

- Includes leading hospitals and specialist centers.

- Offers higher room categories and advanced facilities.

- Best suited for corporate or executive plans.

Comparison Table:

| Type of Network | Coverage Level | Benefits | Ideal For |

|---|---|---|---|

| Basic Network | Limited hospitals | Lower premiums, essential coverage | Low-income plans, basic employee cover |

| Standard Network | Moderate | Wider options, good accessibility | Families, mid-tier corporate plans |

| Premium Network | Extensive | Premium facilities, best specialists | Executives, business owners |

Specialized vs. General Network Hospitals

Some insurers also maintain specialized networks for fields like maternity, cardiology, or orthopedics. This ensures patients receive focused care under negotiated pricing models.

Benefits of Choosing a Network Hospital

Financial and Operational Advantages

Choosing a network hospital offers both financial and logistical benefits for insured members. With cashless treatment, patients avoid upfront payments, and insurance companies manage billing directly. This simplifies hospitalization and emergency response.

Key Advantages:

- No immediate financial burden during treatment.

- Reduced administrative paperwork.

- Faster claim approvals through pre-authorization.

- Standardized pricing ensures fairness across the network.

In the UAE’s healthcare ecosystem, insurers and TPAs continuously audit network hospitals for quality control. This ensures that patients receive regulated, transparent, and reliable care.

Convenience and Assurance

Beyond cost efficiency, network hospitals provide convenience and peace of mind.

- Assured Quality: Only DHA or HAAD-accredited hospitals qualify for inclusion.

- Streamlined Access: 24/7 emergency coordination between TPAs and hospitals.

- Predictable Costs: Rates pre-agreed by insurers avoid unexpected billing.

- Direct claim settlement

- Consistent service standards

- Nationwide accessibility across Emirates

Limitations of Network Hospitals

Restricted Choices and Accessibility

While network hospitals bring convenience, they also come with certain constraints.

The most common limitation is the restricted choice of providers. Only hospitals within the approved list are eligible for cashless treatment.

If a policyholder chooses a non-network facility, treatment is possible only through reimbursement—subject to policy limits. Additionally, some plans limit coverage to hospitals within specific Emirates, impacting individuals who travel frequently.

Coverage and Service Restrictions

Certain high-end services, room categories, or elective procedures may not be fully covered even within the network. Common exclusions include:

- Cosmetic and elective surgeries

- Non-essential investigations

- Room upgrades beyond the policy category

Key Limitations:

- Annual network updates may change hospital listings.

- Emergency coverage abroad may require add-ons.

Room class and treatment limits may vary by insurer.

How to Choose the Right Network Hospital in the UAE

Evaluate Network Lists Before Purchasing Insurance

Selecting the right hospital network requires due diligence. Policyholders should always review the insurer’s latest hospital list available on company websites or mobile apps—before purchasing or renewing a plan.

Evaluation Factors:

- Proximity: Ensure network hospitals are conveniently located near home or workplace.

- Specialization: Confirm availability of required specialties (maternity, cardiac, pediatric).

Accreditation: Look for DHA, MOH, or HAAD-certified hospitals for compliance.

Compare Insurers’ Hospital Networks

Different insurers maintain distinct coverage lists. Comparing these can help identify which network best aligns with lifestyle and healthcare needs.

Example Comparison:

| Insurer | Network Type | Coverage Strength | Notable Hospitals |

|---|---|---|---|

| Daman | Enhanced Platinum | Broad, includes top UAE hospitals | Cleveland Clinic, NMC |

| Orient | Gold Network | Balanced accessibility | Mediclinic, Aster |

| AXA | Star Network | Premium coverage | Saudi German, Canadian Specialist |

- Review hospital network before renewal.

- Verify emergency care coverage.

- Confirm maternity and specialist inclusion if required.

Kingsley Maybrook’s Advisory on Health Insurance in the UAE

As a trusted advisory and consulting firm, Kingsley Maybrook supports individuals, families, and corporates in structuring effective insurance portfolios across the UAE. Understanding the nuances of network hospitals, policy limitations, and insurer comparisons requires expert insight—something our advisors deliver through tailored consultation.

Our Expertise Includes:

- Health and employee benefit advisory

- Wealth and succession planning for families and executives

- Corporate structuring and compliance with UAE financial regulations

- Tax and transaction advisory for businesses with cross-border operations

By working with Kingsley Maybrook, clients gain clarity on selecting policies aligned with lifestyle, corporate budgets, and regulatory standards. Our advisory services extend beyond health coverage to include comprehensive wealth, tax, and business planning strategies.